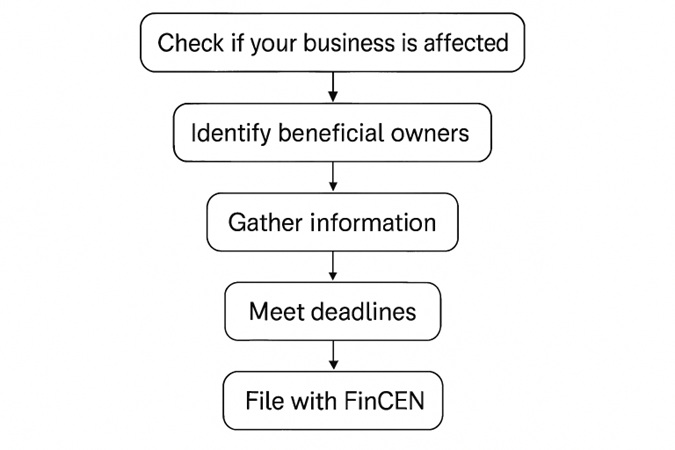

- The Corporate Transparency Act (CTA) requires many U.S. businesses to disclose information about their beneficial owners to combat fraud, tax evasion, and money laundering.

- Not all businesses are subject to the CTA; exemptions include publicly traded companies, large operating businesses, and certain regulated entities.

- Beneficial owners are individuals who exercise substantial control or own at least 25% of a company, and their accurate identification is essential for compliance.

- Companies must gather specific personal information from each beneficial owner, including full name, date of birth, address, and a government-issued ID number.

- Timely reporting to FinCEN is critical, with deadlines varying based on the company’s formation date, and failure to comply can result in civil or criminal penalties.

- Compliance is ongoing; businesses must update their records and report changes in ownership or identifying information within 30 days.

- Engaging legal counsel or compliance professionals can simplify the process, reduce risks, and ensure accuracy in reporting.

Understanding The Corporate Transparency Act

The Corporate Transparency Act (CTA), signed into law in 2021, is a significant piece of legislation aimed at fighting fraud, tax evasion, and money laundering by requiring certain U.S. businesses to disclose information about their beneficial owners. By mandating that companies provide identifying details about the individuals who ultimately control or profit from them, the CTA targets criminal misuse of anonymous companies. If your business is unsure about compliance requirements, reviewing resources from cunninghamlegal.com can help clarify your obligations and guide you through necessary actions.

The CTA’s requirements are designed to shed light on entities that, in the past, could hide ownership behind layers of legal structures. The Financial Crimes Enforcement Network (FinCEN) is the agency administering this process, collecting detailed beneficial ownership information that will be safeguarded but accessible to law enforcement and other authorized parties. By increasing transparency, the law aims to foster a fairer business climate and global trust in U.S.-based companies.

Determine If Your Business Is Affected

Compliance with the CTA does not apply uniformly to all businesses. The law generally targets corporations, limited liability companies (LLCs), and similar U.S. entities that are created by filing a document with a secretary of state or an equivalent office. Foreign entities registered to do business in the U.S. are also covered. Exemptions, however, are provided for over 20 categories of entities, including publicly traded companies, certain large operating businesses, and heavily regulated entities such as banks and insurance companies. Carefully evaluating your entity’s eligibility and exemption status is an essential first step.

Large operating companies are notably exempt if they employ more than 20 full-time employees in the U.S., maintain an operating presence at a physical office within the country, and report gross receipts or sales exceeding $5 million in the previous year. For more details on whether your company qualifies for an exemption, the U.S. Department of the Treasury has published additional guidance for business owners and advisors.

Identify Beneficial Owners

Once you confirm your company must comply, the next step involves identifying your “beneficial owners.” Under the CTA, these are individuals who, directly or indirectly, exercise substantial control over the entity or own or control at least 25% of its ownership interests. This group can include senior officers, individuals with the authority to appoint or remove directors, or anyone capable of making significant decisions about the entity’s business or finances. Accurately determining beneficial owners is crucial, especially for companies with complex ownership structures.

It is not uncommon for small businesses or closely held corporations to have two or three beneficial owners, while more complex organizations may have a greater number. In situations where it’s unclear who meets the criteria, companies should err on the side of over-inclusiveness, documenting the process they used to make determinations and consulting legal counsel for assistance if necessary.

Gather Required Information

Every beneficial owner must provide specific personal identifying information to ensure compliance with applicable regulations. These details include:

- Full legal name

- Date of birth

- Current residential or business address

- Unique identifying number from an accepted identification document (such as a passport or driver’s license)

It is crucial to collect accurate and up-to-date information for each beneficial owner to minimize the risk of penalties for incomplete or incorrect reporting. Companies should establish a secure and confidential process for collecting and storing these sensitive details.

Understand Reporting Deadlines

One of the most important compliance obligations under the CTA is meeting key reporting deadlines, which are determined by the formation date of your entity:

- Existing Companies (formed before January 1, 2024): File initial Beneficial Ownership Information Reports (BOIR) by January 1, 2025.

- New Companies (formed between January 1, 2024, and January 1, 2025): File within 90 days of formation.

- Companies formed on or after January 1, 2025: File within 30 days of formation.

Timely compliance with these deadlines is crucial, as failure to file or submit false information can result in significant civil and criminal penalties.

File Your Report With FinCEN

With all necessary personal and company details in hand, preparing and filing your Beneficial Ownership Information Report is the next step. Reports must be submitted electronically via FinCEN’s secure online portal. The portal is designed for ease of use, allowing businesses to upload documents and verify information. Still, attention to accuracy is paramount—incorrect or incomplete filings can trigger compliance reviews or enforcement actions.

Maintain & Update Records

CTA compliance is not a one-time process. Businesses must continuously update their records and submit amended reports within 30 days of any change to previously reported information. This includes changes in a beneficial owner’s identifying details or the company’s structure. Establish a system to regularly review ownership data and communicate with stakeholders to facilitate proactive compliance.

Seek Professional Assistance

Navigating the regulatory complexities of the Corporate Transparency Act can be challenging, especially for closely held and multi-level entities. Engaging legal counsel or a specialist in business compliance can substantially lower risk, ensure all reporting is accurate, and avoid harsh civil or criminal repercussions. Qualified professionals can also help interpret ambiguous situations and adapt compliance systems as federal regulations evolve.

Final Thoughts

Complying with the Corporate Transparency Act is a critical responsibility for many U.S. businesses, and it plays a vital role in promoting transparency and protecting the financial system. By familiarizing your team with the requirements, identifying all beneficial owners, reporting complete and accurate information, and staying vigilant about any ownership changes, your organization can ensure it remains fully compliant while contributing to broader anti-fraud efforts.