The Current State Of The Market

The housing market is constantly shifting, making big decisions feel overwhelming. Should we rent, buy, or even consider moving to a new city? These are huge questions, impacting our finances and our futures.

We understand the uncertainty. Economic signals are mixed. Interest rates keep changing. Some areas see prices climb, while others cool down. This leaves many of us unsure of the best path forward.

We will cut through the confusion. We aim to provide clear, expert insights into today’s complex housing landscape. We will explore key market trends, help you weigh your options, and offer forecasts for 2025 and 2026. Our goal is to help you steer these challenging times with confidence.

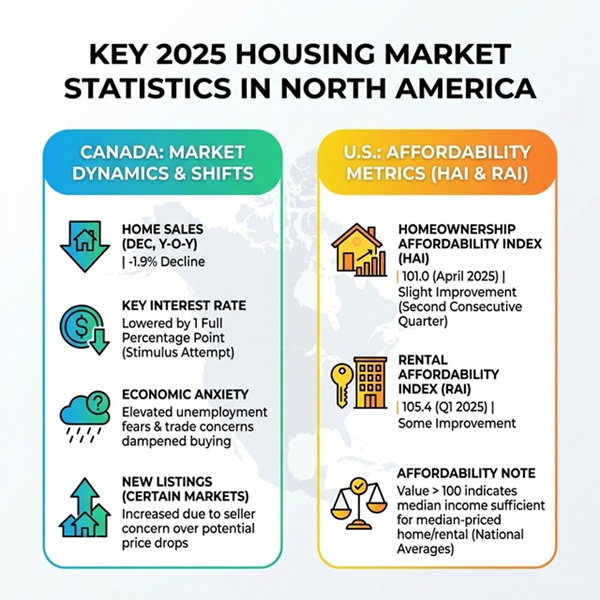

The Canadian housing market in 2025 was a year of paradoxes: lower interest rates yet heightened economic anxiety. Nationally, home sales in Canada saw a 1.9 percent decline in December compared to the previous year, capping a generally subdued year. This national trend, however, masks significant regional variations, painting a picture of fragmentation rather than uniformity.

Economic factors played a pivotal role in shaping market dynamics. The Bank of Canada, for instance, lowered its key interest rate by a full percentage point in 2025, a move that typically stimulates buying activity. Yet, this monetary easing was often overshadowed by lifted unemployment fears and broader economic uncertainties, including renewed concerns over U.S. trade relations. These anxieties kept many potential buyers on the sidelines, particularly in major urban centers.

Seller sentiment also underwent a notable shift. In markets experiencing a slowdown, there was a growing sense among some sellers that waiting might lead to lower prices, prompting them to consider selling sooner rather than later. This increased the influx of new listings in certain areas, further contributing to downward price pressure.

As we look at the broader picture, it’s clear that the Canadian housing market is navigating a complex interplay of forces. Understanding these elements is crucial for anyone contemplating a housing decision in the coming years.

The Big Question: To Buy or to Rent?

For many, the fundamental question remains: is it better to buy or to rent? This decision is particularly complex in the current climate, where an affordability crisis persists alongside fluctuating interest rates.

Our analysis of affordability metrics reveals a nuanced picture. The Homeownership Affordability Index (HAI) and Rental Affordability Index (RAI) are critical tools for understanding the financial feasibility of each option. In the U.S., for instance, the homeownership affordability index stood at 101.0 in April 2025, improving slightly for a second consecutive quarter, yet still indicating challenges for many. The rental affordability index, at 105.4 in Q1 2025, also showed some improvement but highlighted ongoing pressures. A value above 100 on these indices generally means the median income is sufficient to qualify for a median-priced home or rental, respectively. However, these national averages can mask significant local disparities.

First-time homebuyers, in particular, face considerable problems. High entry costs, coupled with the lingering effects of the mortgage stress test in Canada, mean that many young Canadians struggle to enter the ranks of homeownership. Policy delays, such as the deferred improved GST rebate for first-time homebuyers, further compounded this challenge, leaving many waiting on the sidelines for legislative clarity.

Adding to the complexity is the sentiment among sellers. In many markets, 2025 was characterized by seller frustration, with high delisting rates indicating that many homeowners were pulling their properties off the market rather than accepting lower offers. In the U.S., for example, delistings in October 2025 increased 45.5% year to date and 37.9% year over year, making it the year with the highest national delisting rate since 2022. This phenomenon underscores a disconnect between seller expectations and buyer willingness, contributing to market stagnation in some areas.

Weighing The Financials Of Buying

For those considering homeownership, the financial implications are substantial and long-term. On the one hand, buying a home offers the significant advantage of building equity over time, essentially serving as a forced savings plan. Once a mortgage is secured, a portion of each payment contributes to ownership, and the principal balance decreases. Moreover, fixed-rate mortgages offer predictable monthly payments, providing stability against future rent increases.

However, the entry costs are high. Beyond the down payment, buyers must contend with closing costs, legal fees, and often property transfer taxes. Once owned, the responsibilities don’t end. Maintenance and repairs, property taxes, and home insurance are ongoing expenses that can be substantial. The national average price for a home in Canada rose to nearly $700,000 in 2025, a significant increase from below $500,000 before the COVID-19 public health crisis. This price point, even with anticipated mortgage rate reductions, means a substantial financial commitment.

Analyzing The Flexibility Of Renting

Renting, by contrast, offers considerable flexibility and lower upfront costs. Renters typically avoid large down payments, closing costs, and property taxes. The responsibility for maintenance and repairs falls to the landlord, freeing up both time and money for the tenant. This mobility is a key advantage, allowing individuals or families to relocate more easily for job opportunities or lifestyle changes without the complexities of selling a property.

However, renting comes with its own set of financial considerations. Rising rental costs are a concern in many markets, and unlike a fixed-rate mortgage, rent can increase year-over-year. The most significant financial drawback is the lack of equity building; rent payments do not contribute to personal wealth accumulation in the same way mortgage payments do.

When deciding whether to rent or buy, we encourage you to ask yourself these key financial questions:

- What is our current financial stability? Do we have a secure income, a healthy emergency fund, and manageable debt?

- How long do we plan to stay in one location? Buying typically makes more financial sense for longer-term plans (5+ years).

- Can we comfortably afford the total costs of homeownership? This includes not just mortgage payments, but also property taxes, insurance, utilities, and potential maintenance.

- Are we comfortable with the responsibilities of home maintenance?

- What are the local market conditions for both buying and renting? Are prices and rents rising, falling, or stable?

- What are the current interest rate forecasts? How might they impact our mortgage payments or investment returns?

The choice between renting and buying is deeply personal, contingent on individual financial health, lifestyle preferences, and long-term goals.

The Relocation Option: Exploring Divergent Regional Markets

The Canadian housing market in 2025-2026 is best characterized by its fragmentation. While national headlines might suggest a uniform trend, the reality on the ground is a patchwork of cooling markets and surprisingly hot pockets. This regional divergence is a critical factor for anyone considering a housing move, especially for those contemplating relocation. The post-COVID correction, which saw prices in some areas surge and then retract, has further exacerbated these differences, driven by unique supply and demand imbalances in various cities and provinces.

Where The Market Is Cooling Down

Major metropolitan areas, once the epicenters of Canada’s booming housing market, experienced a significant cooldown in 2025. Toronto, for example, saw just 62,433 homes sold last year, marking the lowest level since 2000. This represented an 11.2 percent drop in home sales in the GTA compared to 2024. Similarly, Vancouver notched only 23,800 home sales, a figure even lower than during the 2008 financial crisis, indicating a profound slowdown. British Columbia as a whole saw sales tumble about 6% last year, leading to a roughly 3% decline in average prices, with Vancouver sales and prices down 4% and 10% respectively.

More broadly, housing markets in Southern Ontario and parts of B.C. have cooled considerably. Hamilton home sales in December 2025 were their slowest since 2010, dropping 12 percent year over year. This trend is largely due to an influx of new listings, which has put downward pressure on home prices and shifted conditions towards a buyer’s market. Many buyers in these regions stayed on the sidelines, spooked by lifted unemployment and broader economic anxieties. The significant price gains seen post-COVID-19 in these areas are now undergoing a partial reversal, leading to a more significant correction.

Where The Market Remains Hot

In stark contrast to the cooling giants, several Canadian markets demonstrated remarkable resilience and even growth in 2025. Quebec City, for instance, saw a whopping 17 percent price increase year-over-year, driven in part by the Bank of Canada’s interest rate cuts and the city’s relative affordability. Similarly, Saskatchewan’s average home prices were up 9% in 2025, reflecting solid affordability and tight supply.

The Atlantic provinces, including Newfoundland and Labrador, Prince Edward Island, Nova Scotia, and New Brunswick, also experienced stable or hot activity. Newfoundland and Labrador’s price growth last year outpaced Canada’s by the largest margin since the Global Financial Crisis, while Nova Scotia and New Brunswick saw prices roughly 90% above pre-pandemic levels. The Prairies, including Manitoba and Alberta, generally maintained superior affordability due to smaller price run-ups during the pandemic and weaker price growth in preceding years.

These regions often function as “refuge markets,” attracting buyers seeking better affordability and a different quality of life away from the high costs of major urban centers. This phenomenon is not unique to Canada; in the U.S., smaller, traditionally affordable metros have seen price appreciation as buyers shift away from more expensive areas. For those interested in exploring vibrant urban environments with a more accessible cost of living, understanding the Detroit Michigan housing market nightlife can offer valuable insights into the potential of such refuge markets.

Key Factors Shaping The 2025-2026 Housing Market

As we look ahead to 2026, the Canadian housing market is ready for a gradual, modest recovery, largely supported by pent-up demand. However, this recovery will be tempered by persistent economic headwinds, including lifted uncertainty and a subdued job market. Understanding these underlying factors is crucial for anyone trying to make sense of the market’s trajectory. For those seeking comprehensive resources on Navigating challenging housing market conditions, there are many valuable insights available online.

Economic Drivers & Their Impact On The Housing Market

Monetary policy played a significant role in 2025 and will continue to influence the market in 2026. The Bank of Canada’s decision to lower its key interest rate by a full percentage point in 2025 provided some stimulus, especially in more affordable markets. However, the U.S. Federal Reserve’s actions and global inflation trends also cast a long shadow. While the BoC is widely anticipated to continue cutting interest rates in 2025, the pace and extent of these cuts will dictate borrowing costs and buyer confidence.

Unemployment fears and broader economic anxiety, partly fueled by potential trade uncertainty and renegotiations of pacts like CUSMA, are expected to keep some buyers cautious. A strong labor market is critical for housing demand, and any weakness could further dampen activity. The direction of the Canadian economy, particularly the labor market, will be a key determinant for housing market performance throughout 2026.

Supply-Side Pressures On The Housing Market

The supply side of the housing market faces significant challenges. New construction starts, while showing some growth, are still not meeting the country’s housing needs. In 2025, national housing starts were 259,028, falling significantly short of the needed 480,000 units targeted by CMHC.

A notable trend is the shift in the composition of these stars. Urban housing starts rose by 6% between 2024 and 2025, primarily driven by a 28% increase in purpose-built rental markets. In contrast, starts for ownership housing declined by 10%. This means that while more homes are being built, fewer are becoming available for purchase, exacerbating supply issues for prospective homeowners. In 2020, ownership market share represented 69% of the total, but by 2025, this dropped to 49%.

Builder sentiment, as measured by the Housing Market Index (HMI), hit record lows in Q4 2025. The single-family index fell to 19.6, and the multi-family index was 14.7. This reflects a critical low point in new-home sales conditions and future industry capacity. Ontario’s annual payroll employment contraction in residential construction pushed 18,000 people out of the industry in 2025, highlighting significant job losses in the sector. This workforce “scarring” could inhibit future capacity to increase housing starts when demand eventually picks up. Builders believe that expanding the federal GST rebate to all buyers under $1.5 million would be the most effective policy to improve new home selling conditions. Land-use regulations and zoning policies also continue to constrain supply, making it difficult to build diverse and affordable housing options.

Frequently Asked Questions About Today’s Market

Navigating today’s housing market often raises a host of questions for prospective buyers and sellers. We’ve compiled some of the most common inquiries to provide clarity.

Are we in a housing bubble?

The question of a housing bubble frequently arises, especially given the rapid price appreciation seen in previous years. Moody’s Analytics noted in April 2023 that an unprecedented number of metro areas were overvalued, with prices exceeding their fundamental value by more than 10 percent. Major Canadian cities like Toronto and Vancouver have consistently appeared on lists of cities with high bubble risk. Toronto, for instance, placed fifth in the 2024 UBS Global Real Estate Bubble Index.

However, the market dynamics suggest a more nuanced picture than a simple national bubble. While some areas are indeed overvalued and have seen significant price corrections (Vancouver’s prices, for example, were down 10% in 2025), other regions, particularly in the Prairies and Atlantic Canada, have maintained better affordability and experienced stable growth. The slowdown in major markets is often described as a “partial reversal” of the post-pandemic surge, rather than an outright crash. This fragmentation indicates that while some areas face bubble-like conditions, a national housing bubble with an imminent, widespread crash is less likely than localized corrections.

What government policies are affecting affordability?

Government policies play a crucial role in shaping housing affordability. In Canada, discussions around an improved GST rebate for first-time homebuyers have been ongoing, but delays in implementing such measures have kept many potential buyers on the sidelines. Builders believe that expanding the federal GST rebate to all buyers (for homes under $1.5 million) would significantly improve new home selling conditions.

Changes to mortgage rules, such as the increase in the maximum mortgage amortization period for first-time homebuyers from 25 to 30 years, and the elimination of the mortgage stress test requirement for straight, stand-alone uninsured renewal switches, are designed to ease access to financing. British Columbia also introduced a 20% house-flipping tax in January 2025, aimed at curbing speculative activity, though its impact on overall affordability is still being assessed. Discussions around zoning reforms and land-use regulations are also gaining traction, as these policies are seen as key to increasing housing supply and addressing affordability challenges.

Is 2025-2026 a good time to buy a house?

Deciding if 2025-2026 is a good time to buy a house requires a personalized assessment of market trends, interest rates, and individual financial circumstances. The Bank of Canada is widely anticipated to continue cutting interest rates in 2025, which could lead to more favorable borrowing conditions. Some forecasts suggest rates could drop by 0.75 percentage points by the end of 2025, potentially reaching two percent. Lower mortgage rates can improve affordability and stimulate demand.

The RE/MAX 2025 Canadian Housing Market Outlook anticipates a 5 percent increase in the national average residential price and sales rising in 33 out of 37 regions surveyed, with some areas seeing sales increases of up to 25 percent. This suggests a market ready for a modest recovery, rather than a steep decline.

However, market timing is notoriously difficult. While interest rates may become more attractive, affordability constraints and limited supply in many areas will persist. For some, particularly those in more affordable “refuge markets” or those with secure finances, 2025-2026 could present opportunities. For others, especially in high-cost major cities, the challenges of stretched affordability may continue. It’s about aligning market conditions with your personal financial readiness and long-term goals.

Conclusion: Making Your Move In A Complex Market

The housing market in 2025 and 2026 is characterized by a dynamic interplay of national trends and stark regional differences. From cooling major urban centers to resilient, growing “refuge markets,” the landscape is far from uniform. Economic anxieties, fluctuating interest rates, supply-side pressures, and evolving government policies all contribute to a complex environment that demands careful consideration.

For individuals and families contemplating a housing decision, the path forward is rarely one-size-fits-all. We’ve seen that the choice to rent, buy, or relocate hinges on a deeply personalized assessment of financial health, lifestyle aspirations, and long-term objectives. While a modest recovery is anticipated nationally, driven by pent-up demand and potential interest rate adjustments, persistent affordability constraints and supply challenges will continue to shape market conditions.

Our advice is to approach this market with cautious optimism, armed with thorough research. Understand your personal financial situation intimately, define your long-term goals clearly, and most importantly, conduct diligent local market research. The national picture provides a backdrop, but the nuances of your specific community will ultimately dictate the best course of action. By staying informed and making decisions custom to your unique circumstances, you can confidently steer today’s complex housing market and make the move that is right for you.